The Path Ahead with Angel City Stakes

Methods for choosing Pools, Liquidity Cycles, New Bridged Assets and more

Hello intrepid pioneers,

As we continue to feel the effects of Terra’s collapse and the depegging of UST, coupled with challenging TradFi markets (which I covered last month), it’s important to focus on your goals and work to realize them through trying times. If you’re using Dollar Cost Averaging (DCA) as a strategy, it is important to follow the strategy regardless of current conditions. When markets are seemingly down day after day, it can be a lot harder to maintain consistent contributions, yet this is where the primary benefit of DCA is derived: purchasing “shares” or coins when price is down relatively.

TL;DR

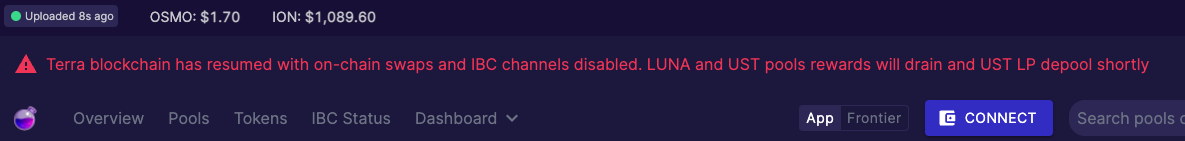

Per Osmosis, IBC transfers of LUNA and UST are disabled - meaning they are “stuck” on Osmosis. Additionally, rewards have stopped for these pools and all UST pools will depool. ACS is unbonding UST and LUNA pools.

I close the loop on Terra by highlighting the trouble its founder and parent company are in, as well as review possible scenarios for a recovery of UST prices on Osmosis and in general.

Money flows tend to happen in cycles; the current liquidity draining from Terra could present a unique opportunity for attracting new capital to Osmosis

It is important that an Osmosis user have some free time every week to research and manage investments and pools

“How I Choose Pools” section covers six things I look at when deciding

Axelar bills itself as a cross-chain communication platform for Web3 that enables the building of secure cross-chain apps

New bridged “axl” assets are available on Osmosis (WETH, DAI, USDC), but these are not without risks as highlighted below

The Stake of the Week is ION Pool #2

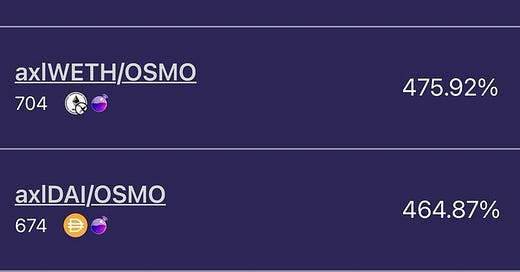

Liquidity Cycles

I’m starting to see some great APR’s return to Osmosis reminiscent of the period shortly after Osmosis was launched in June 2021 (Spoiler alert - rates this high never last long). A sort of silver lining as a result of the liquidity drain caused by Terra. A great “balancing” effect of AMM’s is that if liquidity is down, rates tend to go up to offset the drop, and we’re definitely seeing that of late, helped by governance proposals and new pools. Be sure to read my highlight of the risks associated with bridged assets further below.

Despite headwinds coming from the Federal Reserve, for an investor with a long-term horizon and ability to actively manage pools, this could be an excellent time to get started with Osmosis. Price has dropped to the point where I initially discovered Osmosis before it increased 5x in price in six months, but the team has built so much supporting Osmosis behind the scenes since then. The vision for Osmosis was a decentralized DEX for the Cosmos, but per some latest conversations with co-founder Sunny Aggarwal, is expanding more into a decentralized ecosystem for projects to build on. Although unlikely, it could potentially grow to be bigger than the Cosmos Hub (ATOM) given enough time.

Money flows, trends, and sentiment tend to repeat over and over in a pattern of cycles. This is the cyclical nature of markets that appear at various times and lengths (even cycles within cycles, or creating super cycles). We’ve just undergone a mega liquidity draining event (thanks to Terra exposure) on Osmosis, which means more rewards and fees are available to distribute to any remaining liquidity (the higher APR rates I mentioned). These cycles, although difficult to identify while in process, are easier to spot in hindsight. With APR rates creeping back up, this can attract new liquidity. You can follow the total liquidity, or Total Value Locked (TVL), through the main Osmosis Analytics page: https://info.osmosis.zone/

How I Choose Pools to Bond

I generally follow a more or less standard process for determining what pools to bond to on Osmosis. Before getting started on Osmosis, you should familiarize yourself with liquidity mining concepts and also be available to manage your funds for at least a couple of hours a week. While passive income is generated as part of this process, there will always be required some hours of effort per week/month in order to do your research, compound or withdraw earnings, and migrate pools based on changing conditions. If you don’t have that kind of time or patience to keep up with a fast-changing environment, consider holding Bitcoin or other low inflation cryptocurrencies outright which requires very little time commitment.

Now, here is my process:

Check the Governance section for Osmosis to review upcoming proposals

Usually it is clear which ones will pass before voting closes (5 day period)

This gives you insight into upcoming changes before they happen (E.g. which pools will go Superfluid, which pools will have incentives matched, etc.)

Semi-Automatic Incentive Adjustments for the Week

I look at the proposal every week to see how APR’s will change once voting concludes. Here’s the main auto-updating spreadsheet.

It’s useful for rough estimates of the external APR (Column R, ‘Incentives’)

It provides insight into the Swap APR (Column I, ‘Incentives’). This is a “hidden” APR paid out in additional tokens upon withdrawal of funds.

Check Dexmos App

Dexmos gives you a nice sorted list of pools. I usually sort starting with the highest APR’s first, and make a list of pools that involve projects I can get behind ideally with flat or positive price momentum (and other criteria I look for that helps me select cryptos to supply liquidity to).

Don’t focus simply on the highest APR’s, but rather on the highest APR’s of projects and cryptocurrencies you have vetted and are comfortable providing liquidity for.

Compare current pool APR’s to Dexmos and the Weekly Spreadsheet to see if they’ve changed

Sometimes there may be delays in updating rates or recent liquidity flows may have caused rates to change significantly

I also like to follow new pools closely in the first few weeks to see how fast their rates fall and if they continue to be adjusted upward

Check price action and other metrics on Coingecko.com

As covered in The Importance of Tokenomics a few weeks back

If price has dropped significantly but has maintained long-term stability and value, then this could pose a more attractive pool than a coin that had recently been on a tear.

Evaluate all information against personal risk tolerance and investing goals

Other things I consider are 14, 7, or rarely 1-day bonding periods. If I already have a sizable portion in the 14-day bond, I may decide to bond at the 7-day rate in order to return capital a week earlier. If the token is highly volatile, I may choose a 1 or 7-day bond. Shorter bonding periods can be advantageous when new pools launch and you want to exit one to enter another and capture high APR by getting in as soon as possible. Unlike staking, you must unbond all of your GAMM LP tokens for each time period (you cannot do a partial unbonding of GAMM tokens).

Closing the Loop on LUNA and TerraUSD (UST)

Terra’s founder Do Kwon and its parent company Terraform Labs are facing serious penalties in South Korea for the collapse, where it was initially headquartered, so much so that a task force of the financial crimes unit nicknamed “Grim Reaper” is being put back together to investigate Terra after it was disbanded two years ago.

Osmosis Zone Terra Blockchain Important Announcement

Per the analytics page for Osmosis, IBC transfers of LUNA and UST are disabled - meaning they are “stuck” (at least for now) on Osmosis. Additionally, rewards have stopped for these pools and all UST pools will depool, which I assume means all tokens will be returned for LP share. Although I was hopeful initially for a recovering in the UST peg, at this point there isn’t a clear path forward for UST or LUNA, but hey, anything’s possible.

With remaining funds in related pools, Angel City is unbonding from affected pools. The price of UST on Osmosis is still trading well above quotes on popular crypto sites ($0.06 vs ~$0.21 on Osmosis), so my thinking is that probably better to take what is offered given that it is at least three times more than the general market.

Another option for bagholders is to wait it out as the Terra community works to come up with a plan to salvage any remaining value (which is still somehow hundreds of millions of dollars between LUNA and UST) and rebuild. Discussions have included options such as pushing a hard fork or creating a LUNA v2 (new blockchain), creating something similar to Ethereum and Ethereum Classic (E.g. LUNA classic). The efforts for this will likely come from the developer community (rather than the parent company), or what remains of it after several have looked to move on to new projects.

A longshot option could come from Osmosis itself. I could potentially see a proposal being sent for governance vote that would allocate OSMO community funds to make UST investors on Osmosis blockchain whole. But this is tricky and would mean some form of marking Osmosis UST tokens from others, or restricting the IBC bridge in/out of Osmosis.

With so many new pools launching for bridged assets, I rather use what is left of UST funds to start capturing the excellent APR’s, instead of wait on assets not actively earning. But that’s just me.

Introducing Axelar

Axelar is a platform that allows its users to build “secure cross-chain applications.” Similar to the Cosmos Hub SDK, Axelar provides a standard framework and toolkit to create cross-chain apps. Five years ago, this would have been extremely rare and difficult to do, but we now live in a multi-cross-chain reality.

Per its website, Axelar supports innovation in NFTs, DeFi, AMMs, cross-chain synthetics, and a novel concept called “open gaming.” Axelar on Cosmos allows dev teams to bridge assets from other chains to Cosmos, such as Ethereum based tokens. These tokens are often shown in their native symbol listing (E.g. USDC, WETH) but in other locations they’re represented with the prefix “axl” for example, “axlUSDC”.

Using bridged tokens always presents an additional risk because if the bridge is compromised, it could lead to a hack where users drain bridged assets, as recently happened with Solana’s Wormhole bridge hack. Per its website, Axelar has been audited by NCC, Cure53, and Oak Security, and appears to have a strong team. Although given what happened with UST, this could be a difficult risk for investors to stomach right now, and many may choose to stay away from bridged assets as not worth the risk. For those that venture forth, diversification to other or non-bridged assets is essential protection.

Angel City Stake of the Week

This week’s stake is Pool #2, ION/OSMO.

This pool is unique because it features a ratio of 20% OSMO to 80% ION, which will help mitigate against impermanent loss (much better than if it were 50/50). This also has the added benefit of allowing users that want to speculate on ION and earn rewards, to do so with a smaller total amount of capital (80% of pool will be ION).

ION has a total supply of 21,294, all of which are already created, although a majority of these tokens are held by the ION DAO treasury. We know from recent updates from the Lab that the ION DAO website finally launched after much planning, and the DAO plans to ramp up operations and share details of the project in the coming months. ION was initially created as a complement to OSMO with no purpose, with most agreeing that the purpose could be developed at a later date. As a result the project has been somewhat mysterious. ION LP holders could be entitled to an airdrop when the project kicks off, and the price of ION could rise as activity picks up. We also know from the developers of CRAFT (minecraft-style game token in development), that ION holders and LP holders may be eligible for CRAFT airdrop bonus (we just don’t know if the snapshot has already been taken).

ION is a speculative investment with no defined purpose, but full of potential. The fact that there is no inflation will go a long way to supporting price, although they may add a staking feature in the future. Historically it’s been volatile going from sub-$1,000 to over $20,000 (around the initial hype of the ION DAO), and back (currently trading at ~$1,100 at time of publication), so this may be a token where “less is more” - especially as even a small amount could qualify holders for airdrops in the future. Users may also benefit by holding a small amount of ION outright, in addition to bonding to Pool#2.

For more information about ION, please see: https://gov.osmosis.zone/proposal/discussion/3100-ion-dao-and-treasury.

As always, Angel City Stakes is here to help, educate, and inform. Please reach out to us if you have any questions or would like assistance with staking, liquidity mining, or Osmosis. If you enjoyed this post, please share or subscribe, and thank you for reading.

Stay nimble,

Mike, ACS Founder